Blog

17th December 2018

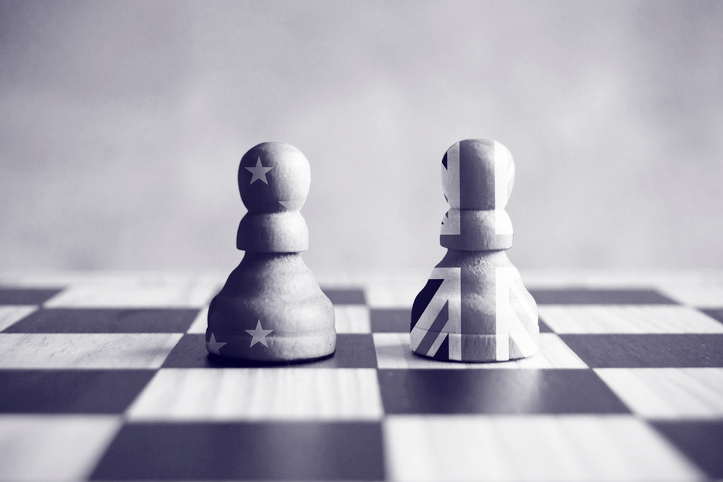

Brexit is still very much a dark cloud looking over the UK and the media gives us little chance for respite. Nobody can be sure of the long-term economic outlook of the country as of Friday 29th March 2019, but...

Read More

How Many Investments Can I Have?

27th November 2018

Although it sounds terribly mundane, how many investments you have depends on your circumstances. What suits you is contingent on the amount of money you have, how much time you have and what opportunities you wish to involve yourself with....

Read More

4 Key Considerations When Investing in Property

One of the most popular types of investment is property. Investing in bricks and mortar has, for a long time, been considered one of the most profitable and reliable opportunities available. Furthermore, with a barrage of investments to choose from...

Read More

6 Questions You Should Ask as a New Investor

26th November 2018

Everyone has to start somewhere and being a new investor is by no means a bad thing. Some even say coming into the game with a fresh mind could have its benefits. That being said, never go in to an...

Read More

Round-Up of the 2018 Autumn Budget

22nd November 2018

On the 29th October 2018, the Chancellor Philip Hammond delivered the Autumn Budget; the last budget before Brexit. As we head towards March 2019 many British citizens are now considering how they might change their personal finances in light of...

Read More

Will Generation Y Ever Easily Buy a Property Without Help?

20th November 2018

With salary increases not matching the rate of property price inflation, it is not surprising that many assigned the label of Generation Y are struggling to secure mortgages. Owning a home in the future is extremely important to young adults...

Read More

4 Budgeting Techniques to Try

31st October 2018

The internet is brimming with information on the best ways to save money and there are countless budgeting methods available to trial. However, it can be hard deciding which technique suits you best, especially if tracking your income and expenses...

Read More

How to Clean Up Your Credit Score

24th October 2018

Your credit score is essentially your financial footprint. It affects your ability to apply for a mortgage in the future, as well as loan and credit card applications in your name. Essentially, to lenders, your credit score determines how reliable...

Read More

What does Brexit mean for investors?

23rd October 2018

Following the conclusion of the referendum, which resulted in the majority voting to leave the EU, experts have been attempting to forecast the future of the UK economy. Despite the initial shock of the result, the British markets have reacted...

Read More

Has the Northern Powerhouse Delivered Yet?

3rd October 2018

The aim of the Northern Powerhouse was to boost economic growth in the North of England’s ‘core cities’ to rebalance the UK economy away from London and the South East. Four years on from the announcement, has the Northern Powerhouse...

Read More