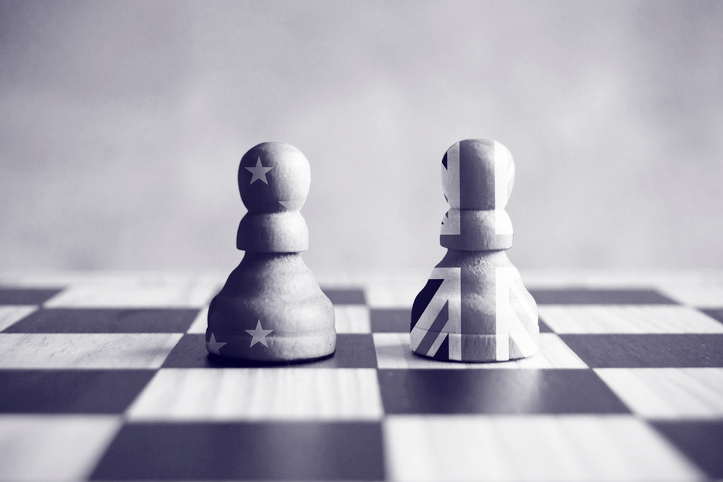

Brexit is still very much a dark cloud looking over the UK and the media gives us little chance for respite. Nobody can be sure of the long-term economic outlook of the country as of Friday 29th March 2019, but many investors have been wondering how it will affect them in the future. With the Brexit deal still very much undecided many people are fearing a hard Brexit or a no-deal scenario.

Future investments

The two primary areas that could most likely be affected are stocks and currency. Individuals looking to invest money into these fields will need to consider the effect Brexit could have on returns.

However, nobody can predict any level of fallout from Brexit. Financial markets do not like ambiguity and the lack of decision making is causing alarm bells to ring in the minds of some financial professionals and investors. Due to this, many investors are expected to see how markets pan out regarding stock and currency investment following March of next year.

Whatever investments you may be considering for 2019 it is worth understanding the potential financial outcomes that Brexit could cause investors in the UK.

Brexit issues investors could face

As we echo, nobody knows what will happen between now and Brexit. However, financial experts have been mulling over the following possible scenarios and outcomes:

No-deal Brexit

By far the most pressing concern to investors of all creeds is a no-deal Brexit. If the UK and the EU cannot agree on a departure deal it could have a huge negative impact on any invested money as the entire UK economy could flatline. Financial experts are warning that if there is even a whisper of a no-deal Brexit that investors should seek specialist advice to avoid potentially losing money.

Weakness in the pound

Since Article 50 was triggered sterling has been volatile. Anyone with investments in the UK pound are advised to keep an eye on them as uncertainty the nearer we head towards March 2019 will likely cause the pound to weaken further. Investors would be wise to keep abreast of Brexit-related news.

Decline in the stock market

When the Brexit vote was announced, the stock market did take a tumble. However, Article 50 and subsequent negotiations, or lack thereof, have only had a minor impact because the markets knew Brexit was coming and had already factored it into prices. However, nobody can predict where the FTSE 100 will head in 2019 but any Brexit difficulties could see the markets plummet as they react to anything negative that is occurring.

Changeable markets

Regardless of investment choices, one big problem for most financial professionals at this time is how unpredictable the markets are. Even a minor comment or rumour about Brexit can cause stock and UK currency prices to plummet. Currently, UK citizens only have the word of the government and political hear to base their judgements upon. A lack of hard facts from negotiations is causing some to lose faith in the government and this is having a direct impact on financial markets.

Political concerns

For investors, Brexit and finances go hand in hand. Whilst some argue that a deal is soon to be agreed, and that negotiations are more on-track than ever, there is still over three months of conversation to get through. Any Brexit-driven political issue could be bad for investors as it could their investments struggle.

Interest rates

Despite not knowing how Brexit will unfold, any decision will have a knock-on effect as to how the Bank of England will react. Whilst it will undoubtedly affect financial markets, the UK interest rates would most likely be affected, with the Bank of England cutting them. This would be problematic for those with stocks in finance-related companies.

The future of investing and Brexit

Amongst all of the uncertainty, one thing many agree on is that 2019 will be a tumultuous year thanks to Brexit. Whilst being aware of some potential problems ahead of time could help keep investments safe, it is important to remember that investing has always been a risk.

Many investors are opting to diversify their portfolios in a bid to spread their risk. However, if you are in any doubt about your investments or portfolio, we would strongly recommend that you consult an independent financial advisor prior to investing.