Blog

31st December 2018

The world is constantly seeking the next big thing and, often, investors make it happen. Whilst some products flop, others flourish. Throughout history there have been some ridiculous business ideas that many investors shunned, unable to see how they could...

Read More

What is the Difference Between Saving and Investing?

27th December 2018

Saving and investing can sometimes go hand in hand. Its when they become intertwined that people start to lose a grasp on the differences between the two and they are synonymous terms. Whilst saving and investing are definitely related, it...

Read More

9 of the Best Apps to Help You Save for a Deposit

24th December 2018

For those who are edging nearer and nearer securing their own property, these apps below can help make that dream a reality. House deposits are notoriously hard to save for, so why not utilise technology to make things a little...

Read More

Are You Making the Most of Your ISA Allowance?

19th December 2018

The tax year started in April 2018, but it’s not too late to make the most of your ISA allowance if you haven’t done so already. For the 2018/2019 tax year you can invest £20,000 in ISAs, you aren’t just...

Read More

Our festive opening hours

18th December 2018

Our office opening hours for the festive period are as below: 24th December - Closed 25th December - Closed 26th December - Closed 27th December - 9.00am to 1.00pm 28th December - 9.00am to 1.00pm 29th December - Closed 30th...

Read More

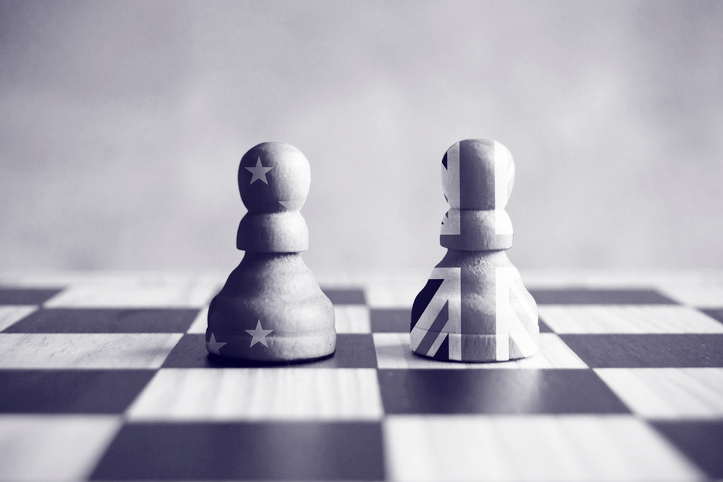

How Could Brexit Affect Investors?

17th December 2018

Brexit is still very much a dark cloud looking over the UK and the media gives us little chance for respite. Nobody can be sure of the long-term economic outlook of the country as of Friday 29th March 2019, but...

Read More