With the mass media stating that the younger generation are doomed for retirement and that pensioners are living on just £22 per day, you’d assume that people were keeping an eye on their financial future. However, with a third of UK citizens living pay check-to-pay check and most people concerned about monetary issues in the here and now, saving for retirement is not something on the radar for most. However, what has caused this issue?

How pension prepared are you?

Research conducted by Wellesley analysed the current pensions of 2,083 UK citizens. Data revealed that just over 1 in 3 people do not currently save into any pension schemes and pay just their National Insurance contribution. 45% of respondees pay into one or two pension schemes, 3.6% into three, and 4.2% into four or more.

Interestingly, 1.6% of those surveyed are currently only paying into a Lifetime ISA for their retirement and 3% are harnessing the Lifetime ISA and one other form of pension scheme.

Those aged 35 and over seem to have a stronger handle on their financial future. 62% of 35 to 44 year olds are paying into at least one or more pension schemes, followed by 66% of 45 to 54 year olds, 47% of 55 to 64 year olds and 36% of the over 65s. However, a staggering, 43% of those aged 35 and over will currently only receive the state pension upon retirement as they are not paying into any pension scheme.

Following suit, 42% of all respondees aged 18 to 34 also voiced that they are not paying into any pension scheme. Some are also not paying National Insurance contributions due to being in education or unemployment.

Where is the pensions pitfall?

There is a serious lack of knowledge amongst UK citizens when it comes to pensions. Changes in products, terminology, and reforms of the market as a whole over the past 30 years is partly to blame for people’s lack of understanding. The government and pension providers haven’t done enough to educate people after changes have been implemented.

Pensions available to UK citizens

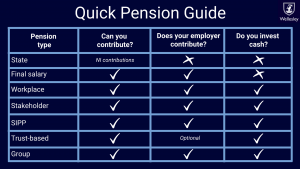

Pensions come in all shapes and sizes and most fall into two categories; final salary pensions and money purchase pensions. Understanding the different pensions available is helpful for financial security.

Money Purchase Pension

Also known as defined contribution schemes, money purchase pensions allow individuals to save into a pension pot. This cash can be drawn upon once they reach the age of retirement or can be swapped for an annuity – a fixed sum of money paid every year for life. These are private pensions and most fall into the following categories:

- Workplace pension scheme – monthly payments are made by individuals and/or their employer. The money is held and invested by a pensions company until retirement.

- Trust-based pension – a form of workplace pension; monthly payments are made by individuals and/or their employer. A board of trustees manage investments on the individual’s behalf.

- Group personal pension – a pension provider is chosen by an employer. The provider claims tax relief at the basic rate on contributions and adds it to the pension pot.

- Stakeholder pension – similar to workplace pensions however they have low and flexible minimum contributions, capped charges and a default investment choice.

- Self-invested personal pension – also known as SIPPS, this personal pension scheme allows individuals to make their own investment decisions from the full range of investments approved by HM Revenue and Customs (HMRC).

Final salary pensions

You may hear final salary pensions referred to as CARE schemes – Career Average Revalued Earnings. They are usually funded by employers, but employees sometimes have the option to pay into them too. With a final salary pension, individuals receive a percentage of their salary either before retirement, or when they leave the company, as an annual income.

Often the percentage is based upon how long the person has worked for the company. Most employees will receive an accrual rate from their employer. For example, if the rate is 1/60th an individual would receive 1/60th of their final salary for every year served. A person who has worked for a company for 20 years would get a third of their final salary.

State pension

Everyone in the UK who has paid National Insurance contributions for a minimum of 30 years will receive the basic State Pension once they reach the state retirement age. The State Pension age is currently under review; however you can check what age you will be eligible to receive your State Pension here. The State Pension is currently £164.35 per week.

Check out the quick guide to all pensions below: