With 24% of UK households having no savings to fall back on it is no surprise that many citizens feel their money disappears quickly every month. Living paycheck to paycheck with little room to put money aside is the norm for much of the population, but could there be a way to improve this?

How often do you check your bank account?

Research conducted by Wellesley analysed the banking habits of 2,022 UK citizens. Data revealed that 1 in 5 of those surveyed check their bank account daily. However, a worrying 4% admitted to never checking their bank account.

Women tend to track their funds closely, with 56% of those surveyed checking their account daily. Men were the polar opposite, with 56% confessing they never check their finances.

Surprisingly, the 25-34 year old age group are the most savvy when it comes to keeping track of their money, with 20% checking their bank accounts daily. Many commented that online banking makes this very easy and helps when saving for property deposits.

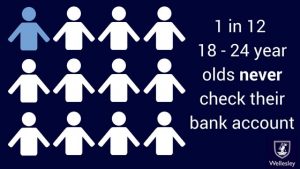

On the opposite ends of the age spectrum, 22% of 18-24 year olds never check their bank account despite being tech savvy, followed closely by 19% of 55-64 year olds.

Why aren’t people checking their bank accounts?

With a staggering percentage of UK citizens never checking their bank account it is no surprise that money is being wasted. Checking your bank account has never been easier due to the emergence of online banking. Below, we outline some of the most common reasons for failing to keep an eye on finances:

- Fearful of account balance and debt

- Have not registered for online banking

- Assuming they can rely on huge overdraft

- Unsure of how to sign in to their online banking

- Loss of online banking login details

- Loss of online banking card reader

- Do not open their paper bank statements

- No access to a local bank branch or ATM

Harnessing at least one method of assessing your spending habits is essential, particularly for those who struggle with saving. Whether it’s logging on and checking online or analysing your bank statements when you receive them, you have to be aware of what you are spending to see where you are potentially letting cash escape you.

Where could you save money?

There are a number of areas to keep an eye out for when you start checking your bank account regularly.

Direct debits

The average UK citizen is spending £112 on direct debits per month. However, £40 of this figure is dead spend as its used on products or services we have forgotten about or no longer use. The main direct debit culprits sapping people’s money tend to be gym memberships, cinema club fees, mobile phone insurance, memberships to museums and the National Trust.

Groceries and eating out

Whether its £5 a day for work lunches, takeaway coffees, or nipping to the supermarket for dinner every day, food is a high spend for most households in the UK. With the ability to now order takeaways online, the average Brit is spending around £80 a month on this service.

Sitting down with your bank statement and totting up your entire spend on food and drinks will likely encourage spending habits to change. Alternatively, if you need extra help, Monzo is part of a new wave of banks. Using an app on your smartphone you can receive instant notifications about your spending habits and utilise their built-in budgeting tool. Similarly, the Curve card account simplifies your finances on to one smart card which is controlled via a mobile phone application.

Overpaying for utility bills and insurance

Shopping around for a better deal on your car or home insurance is a step to consider when the year’s contract is coming to an end. Drivers could shave £63 off of their premium, whereas home insurance could be reduced by £37 by shopping around on renewal.

Similarly, finding an alternative provider for your gas, electricity or water could save you up to £300 per year.

Overdraft charges

Overdrafts are a form of debt and it is best to know the exact state of play of your bank account to avoid going over your overdraft limit and facing nasty charges. Whilst some UK banks such as Santander and TSB have abolished overdraft fees from a selection of accounts, campaigns are ongoing to encourage all providers to follow suit.

Staying on top of your account daily can be key to avoiding overdraft charges and it is also best to sign up to your bank’s text service to avoid going into the red if one is available.

Phone tariffs

The latest phones to release often have the highest tariffs and many are tempted to go for the maximum when it comes to minutes, texts and data. However, 3 in 5 rarely manage to use up all their allowance. If you aren’t using what you are paying for consider lowering your tariff.

How to fix poor money management for good

Bad money habits are hard to break and introducing regular checking of your finances is the only way to keep on top of your spending. Online banking means you can check your account at the touch of a button, via smartphone, desktop, tablet or laptop. Many providers also deliver financial insights into to your spending habits via text or online; pointing out the trends and patterns in your spending that you may want to change.

Checking both debit and credit accounts daily may feel laborious and setting a weekly budget may feel restrictive at first, but with effort they will soon be a normal part of your routine.