FAQs

Please click on a question to view the answer.

You can also use the search function above to find an answer to your question.

General FAQs

General FAQs

Since launching in 2013, Wellesley’s priority was always to offer customers with investment options to meet their needs. Over the years this saw the business evolve from offering peer-to-peer investment products to a selection of mini-bond investment products and, after acquiring FCA approval in February 2019, a listed bond programme which launched in July 2019.

Despite entering 2020 with a performing loan book and confidence in the business model, as the year has progressed the business came under increasing pressure for two key unforeseen circumstances:

Covid19

As you will be aware, the UK entered the depths of the biggest recession on record amidst the Covid19 pandemic. Indeed, all industries were put under additional pressure and we have seen many fellow financial service firms struggle since the UK first went into lockdown.

Throughout this period, the property development market was hit by stress and delays brought about by social distancing measures and issues within the supply chain. We worked closely with our borrowers to provide additional support where needed. Whilst Wellesley had been weathering the storm, it put increased pressure on the business and tightened margins and forecasts.

Ability to raise funds

In June 2020, the FCA announced proposed changes to the regulatory environment that would ban the sale of listed bonds. This ban, which has since been announced as permanent, significantly hindered Wellesley’s liquidity forecast and the business had to act fast to restructure and address these challenges. In doing so, Wellesley has been able to provide a more equitable outcome for investors.

As per Part I of the Insolvency Act 1986 and Part II of the Insolvency (England and Wales) Rules 2016, Wellesley Finance Limited proposed a CVA in order to avoid the alternative of a disorderly wind-down. Following a vote of Wellesley Finance Limited’s creditors to approve the CVA, this is being implemented to bring about a better outcome for all investors.

Over the years Wellesley has offered different investment products, each with unique terms. Depending on the terms, and therefore your agreement with Wellesley, your investments may be impacted differently.

Please refer to the CVA Proposal for further information.

If you’re unsure which Wellesley Mini-Bond you are invested in, you can check your bond certificate which is accessible via your online account. You can access your bond certificate by following the below instructions:

- Login to your account here.

If you're having difficulty logging into your account, please click here.

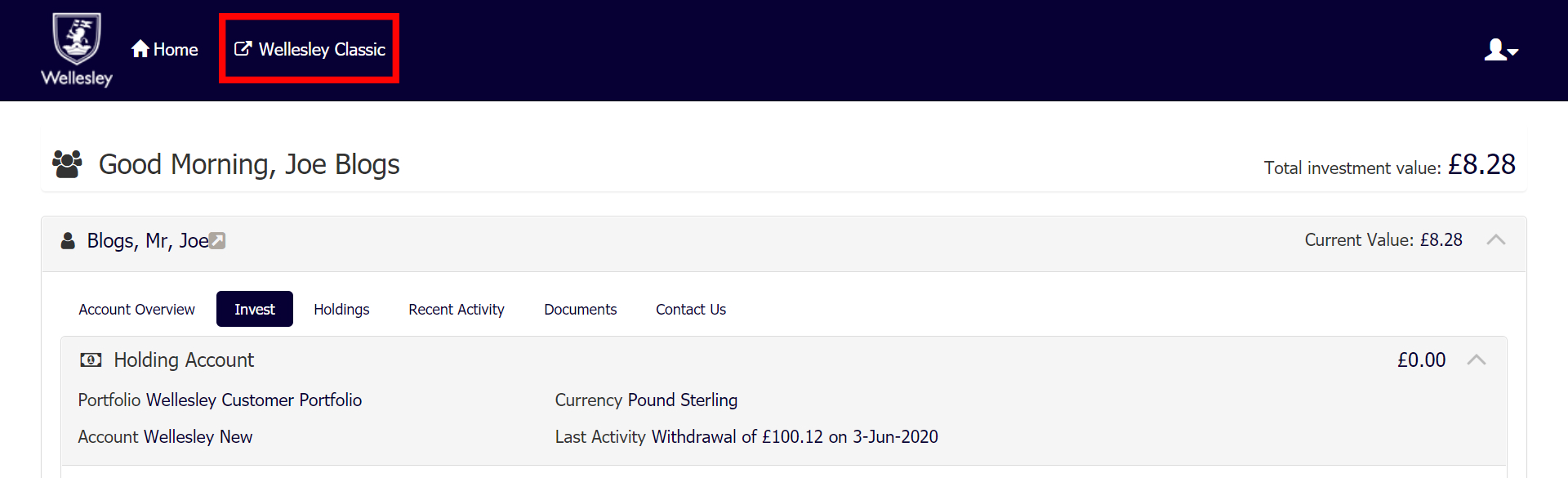

- Click 'Wellesley Classic' from the top menu.

- If a pop-up appears, click the X button to be taken to your account overview screen.

- When on the account overview screen, select ‘Bond Certificate’ under the Wellesley Mini-Bonds Current Holdings sub-heading

- Series 1 was open to investment between 1 August 2014 and 13 December 2015.

- Series 2 was open to investment between 13 December 2015 and 14 February 2018.

- Series 3 was open to investment between 12 March 2018 and 15 February 2019.

As the loan book has been sold, your investments are not directly allocated to individual loans. Instead, in relation to any secured investments you hold, you will receive payments in accordance with the milestones of the loan sale agreement as set out in the CVA Proposal. Separately, the CVA proposes a plan to return further funds (cash) or allot preference shares in Wellesley Finance Plc (equity) to all unsecured creditors who will be compromised through the CVA. This provides the opportunity for all investors to achieve a better outcome than would be likely through a disorderly wind-down.

You can find further information regarding this here.

All live investments are impacted by this announcement. This also includes any matured peer-to-peer investments with an outstanding suspended balance.

The business has always sought to act with integrity and in the best interest of its investors. As the unforeseen events of 2020 have unfolded, Wellesley were proactive in retaining the services of specialist restructuring advisors to assist us in conducting a strategic review of the business. In light of proposed regulatory changes that would restrict our ability to raise funding, we have taken prompt, measured action to preserve the value of your investments via the loan book sale, and through the CVA, which together provide an opportunity of a better outcome for investors.

No, Wellesley is not accepting new investments.

Wellesley is the singular name for the following collective of companies: Wellesley Group Limited, Wellesley & Co Limited and Wellesley Finance Plc.

Wellesley & Co Limited (FRN 631197) is the only regulated entity of the group of companies and is authorised and regulated by the Financial Conduct Authority (FCA).

Duff & Phelps is global professional services advisory firm and an industry-leader of governance, risk and transparency solutions. D&P and in particular their restructuring advisory and regulatory consulting practice groups were appointed to give Wellesley professional advice throughout the resolution and support the delivery of a better outcome for all creditors and customers.

Managing Directors from Duff & Phelps are to act as Nominee and to provide a report in relation to the CVA Proposal as to whether in their independent view, the CVA has a reasonable prospect of being approved and implemented.

https://www.duffandphelps.com/

Shoosmiths is a major UK law firm.

Wellesley has appointed their corporate restructuring & advisory team who specialise in insolvency.

They are appointed to give legal advice to guide Wellesley throughout the CVA process and support the delivery of a better outcome for all creditors and customers.

https://www.shoosmiths.co.uk/

Our customer service support is now provided by Resolution Compliance Limited who can be contacted at [email protected].

We take complaints very seriously. Please do not hesitate to contact us at [email protected], or send a letter to:

Complaints

Wellesley

St Albans House

57/59 Haymarket

London SW1Y 4QX

To view our complaints procedure, please click here.

If we are unable to resolve your complaint to your satisfaction or haven't sent you our final response after eight weeks from the date you originally complained to us, please feel free to contact Financial Ombudsman Service. The details of which are covered in a leaflet which you can find here. https://www.financial-ombudsman.org.uk/businesses/resolving-complaint/ordering-leaflet/leaflet

Resolution Compliance Limited (RCL) is authorised and regulated by the FCA, firm reference number 574048 (further details on RCL’s authorisation can be found here). One of the services offered by RCL is back-up service provider services in order to support existing regulated businesses through similar scenarios to the Wellesley CVA payment process.

RCL has been appointed as Wellesley’s designated back-up services provider. This means that RCL will be supporting you as Wellesley’s customers to ensure that repayments continue to be made, as well as to resolve any questions or queries you may have. RCL will therefore be your primary point of contact for all communications going forward from 1st January 2021.

Your primary source of information will be through Resolution Compliance Limited (RCL), as of 1st January 2021. RCL will provide you with updates and ongoing communications, as well as be your port of call for any questions or queries. From 1st January. You will not receive any communications directly from Wellesley.

Your online account will remain live for the duration of any loan book sale and CVA payments. Here you will be able to access information about your payment plan and make withdrawals as and when payments are paid into your holding account.

Repayment FAQs

Repayment FAQs

Please click here and select your investment to see the payment plan for each investment product. You can view details of your specific returns on your payment plan. This is accessible via the Wellesley Classic section of your online account or / and via an email sent to you by Wellesley.

-

- Login to your account here.

If you're having difficulty logging into your account, please click here. - Click 'Wellesley Classic' from the top menu.

- If you are greeted with a pop-up, click 'make selection' to be taken to the repayment selection page. Alternatively, you can reach the page via the orange banner on your account overview page.

- Here you can view your payment plan and if you hold mini-bond investments, you can individually select your choice of the cash or equity repayment plan for each of your mini-bond investments.

- Login to your account here.

Funds will be paid into your holding account where you can then arrange a withdrawal to your nominated bank account. Your bank account information can be found on the Account Overview page of your online account.

Your estimated returns are estimates based on current information and the business plan that Wellesley Finance Plc will be implementing post-CVA; however, payment is not guaranteed.

Mini-bond investors were invited to select their choice a ‘cash’ or ‘equity’ option for each unsecured investment (Wellesley Mini-Bonds and the unsecured element of The Wellesley Property Mini-Bond). Any secured portions (peer-to-peer investments and the secured element of The Wellesley Property Mini-Bond) will be paid over the same period through the loan book sale.

The cash option will be paid in instalments, as value is recovered, it will be returned to creditors who select this option.

The equity option offers higher estimated returns over a longer period. This is because in selecting this option you will receive preferential shares (therefore making you a shareholder) in Wellesley Finance Limited with an estimated payment value in three to four years. Value created from the work out of the loan book and future business will be returned to you by virtue of your shareholding up to the value specified in the CVA Proposal.

If you did not select your preferred repayment route during the election period, the default repayment option is equity if you hold the Series 2 or Series 3 Mini-Bonds. Whereas if you hold the Series 1 Mini-Bonds or the Property Mini-Bonds, your default option will be cash. These default payments were confirmed to you via email in November 2020.

A six-week period where, mini-bond investors could carefully consider and select a cash or preferred equity payment option.

CVA FAQs

CVA FAQs

A Company Voluntary Arrangement (CVA) is a process that allows a company to come to an arrangement with its unsecured creditors over the repayment of its debts. A CVA allows a company to create a new arrangement that offers a better outcome for its creditors than would be returned to them in an administration.

A CVA Proposal is a contract between a company and its creditors, setting out the revised terms on which the company proposes to reach a settlement with its creditors In accordance with the Insolvency Act 1986, creditors are asked to vote on the CVA and, provided at least 75% of creditors (by value) vote in favour, the proposed CVA will be approved and binding on all creditors.

On 13 October 2020, over 94% of the creditors of Wellesley Finance Plc who participated in the voting process voted in favour of the CVA Proposal.

Accordingly, Wellesley Finance Plc is implementing the CVA to bring a better outcome for all Wellesley Finance Plc investors. Nominated specialist restructuring advisors, Duff & Phelps, have been appointed to act as Supervisors to oversee the process.

Wellesley Finance Limited's directors remain in control of the business throughout the duration of the CVA. The CVA will continue to be monitored by licensed insolvency practitioners from Duff & Phelps who will act as Joint Supervisors.

Loan Book FAQs

Loan Book FAQs

The loan book has been bought by Cloverleaf 376 Limited which is a subsidiary of Wellesley Finance Limited a company within the Wellesley Group. Duff & Phelps’ Real Estate Advisory Group supported Wellesley in undertaking a loan sale process whereby prospective bidders were approached and invited to make offers. It received a number of bids all of which were subject to the bidders carrying out investigations into the loan book and Wellesley Finance Limited. Wellesley submitted its own bid for the loan book based upon an intra-group transfer to Cloverleaf 376 Limited, which was offered at a higher price to the other external bids received. Wellesley Finance Limited's bid was made in order to preserve the underlying value of the loan book for investors.

The loan book was sold to a new Wellesley Group entity, Cloverleaf 376 Limited, prior to the circulation of the CVA proposals. This followed a period whereby the loan book was marketed for sale. It received a number of bids, however none that we believe would deliver the true value of the loan book to investors. Wellesley was able to make an intra-group transfer at a premium price to the bids received on the open market in order to preserve the underlying value of the loan book for investors.

Details of this transaction and how Wellesley Finance Limited was able to sell the loan book can be found within the CVA proposal.

Ahead of the marketing exercise for the loan book commencing, its potential value was assessed by Wellesley, with oversight from Duff & Phelps’ Real Estate Advisory Group. Duff & Phelps oversaw the marketing of the loan book to potential purchasers with this document. Four bids were received following this process, including the bid from Cloverleaf 376 Limited. The process concluded when the new Wellesley Group company, Cloverleaf 376 Limited, purchased the portfolio.

Details of this transaction can be found within the CVA Proposal.

The sale of the loan book is part of a two-phase process designed to provide a better outcome for all of Wellesley’s investors, versus the alternative of a disorderly wind-down.

Primarily the sale of the loan book helps Wellesley’s secured investors (The Wellesley Property Mini-Bonds, The Wellesley Property Bond and Peer-to-Peer investments) by securing a better price for the loans than would otherwise have been likely in the event of a disorderly wind-down and distressed sale. The proceeds of this sale are being delivered on a pro-rata basis to the secured investors. By securing this outcome quickly, Wellesley has been able to preserve the underlying value of the loan book which can be returned to Wellesley’s investors.

Arranging an intra-group transfer for the sale of the loan book allowed Wellesley to secure a premium price for the loan book above the bids received on the open market. Furthermore, in ensuring the loan book continues to be managed by Wellesley, there is opportunity for further value to be retained from the loan book to be passed onto unsecured investors.

The new Wellesley Group entity, Cloverleaf 376 Limited, has bought the loan book from Wellesley Finance Limited on terms which include deferred payments for the purchase price. The purchase price will be paid in three instalments roughly over the course of a year as and when redemptions are made by the borrowers. These dates are December 2020, June 2021 and December 2021.

Please refer the CVA Proposal for further details on this.

The loans within the loan book are backed by properties under development. As the properties are ‘under development’ the future value of the loans (once the developments are complete) will increase over time. Wellesley Finance limited is however unable to fund these developments to completion as it has no funding streams following the proposed regulatory changes likely to be brought in by the FCA. The directors of Wellesley Finance Limited recognised that the overall outcome for the creditors, would be much improved if the developments were able to be funded to completion, but it did not have the funding to do so. As Wellesley has lost its ability to raise funds, there is a funding gap to fulfil the continued cycle of drawdowns.

Asset backed investments were directly linked to the loans via the auto-matching system up to the point of the sale of the loan book. The loan book has been sold as part of the resolution to bridge the funding gap.

Wellesley Finance Limited has sold the loan book. As unsecured investments (The Wellesley Mini-Bond – Series 1, 2 and 3) do not hold a direct claim over the loan book itself, please refer to the below explanations regarding how this process has been transacted across secured investments:

Peer-to-peer investments

The P2P Lender Agreement clause 9.13 appoints Wellesley Finance Plc as agent of the peer-to-peer:

“9.13. You hereby irrevocably appoint the Company as your agent to perform all duties relevant to the Loan Agreements for as long as these Terms remain in force and to manage the recovery processes where any Borrower has failed to make payments to you under any Loan Agreement or where a Default Event has occurred. As part of this recovery process, you provide us with the requisite authority to sub-contract this process to a third party to act on your behalf. The Company has sub-contracted these functions to Wellesley Finance PLC.”

Thus, Wellesley Finance acts as agent for the peer-to-peer investors and was able to sell the loans under the intra-group transfer of the loan book and instructed Wellesley Security Trustee Limited to do so.

Wellesley Property Mini-Bonds

Wellesley Finance as both Originator and agent for the PMB under clauses within the Security Trust Agreement; has authority to effect all relevant transfer agreements (i.e. the agreements to novate the loans from WF to P2Ps or PMBs) and give instructions to WST on that PMB lender’s behalf.

The Wellesley Property Bond

In relation to Listed Bonds WFP has a power of attorney to deal with the Listed Bond loans under the Loan Servicing Agreement:

The Wellesley Secured Finance Base Prospectus sets out that the issuer had appointed Wellesley Finance (WF) as Loan Servicer on its behalf and entered into Loan Servicing Agreement (LSA). As part of that LSA Wellesley Security Trustee Limited (WST) has delegated some of its authority to WF under the terms of the Loan Origination Agreement. Within that capacity WF has the ability to sell any Borrower Loan and its related Borrower Security on behalf of itself, WST and WSF.

Further, in relation to P2P, Property Mini-Bonds and the Listed Bonds:

Clause 7.1 of the Security Trust Agreement (Transfer of Legal Title) contains the provisions by which legal title to the Loans can be transferred on or behalf of the beneficiaries. This clause provides that WST will act on the instructions of a Lender (other than a Third Party P2P Lender or Property Bond Lender) and that WST undertakes to do such acts or things and provide such information as are necessary to transfer its bare legal title in the Loans to such Lender, or any person as such Lender may direct. WFP (as Originator of all of the Loans in the Loan Book) is a Lender under the Security Transfer Agreement and is therefore able to direct WST to sell any of the Loans to such party as WFP directs.

Thus, Wellesley Finance acts as agent for the peer-to-peer investors and was able to sell the loans under the intra-group transfer of the loan book and instructed Wellesley Security Trustee Limited to do so.

By arranging a prompt intra-group transfer of the loan book, Wellesley has been able to retain its value and preserve more capital to return to its investors as part of the CVA.

Your Account FAQs

Your Account FAQs

Please click here for account login support.

Wellesley Classic can be accessed by clicking ‘Wellesley Classic’ from the top menu when you first login to your Wellesley account.

As we're unable to provide any personal advice on tax issues, should you have any queries regarding your tax position or liability, we recommend contacting your local tax office or an independent financial advisor.

In the event of death, your account will be transferred over to your beneficiary who will act on your behalf. Repayment will continue to be made as per your selected repayment terms.

No, none of the Wellesley investment products are covered by the Financial Services Compensation Scheme (FSCS), nor have they ever been.

Wellesley Finance Limited's directors remain in control of the business throughout the duration of the CVA. The CVA will continue to be monitored by licensed insolvency practitioners from Duff & Phelps who will act as Joint Supervisors.

Your personal information can be found by clicking your name on the drop-down menu that can be found at the top right of your screen. Should any of this information need updating, please get in touch with our customer service team on [email protected]

Your bank account information can be found on the Account Overview page of your online account. Should you need to update your bank details, please get in touch with our customer service team on [email protected]

Please note we may require additional documentation to confirm the bank account details you provided are in your name and not a 3rd party.

Any funds held in a customer’s holding account are not invested, they are held within ring-fenced bank accounts and are not impacted by the CVA. You can arrange a withdrawal of these funds to your nominated bank account at any time. To do so please follow the below instructions:

-

- Log in to your Wellesley account here.

- Click the red 'Withdraw Cash' button.

- Please complete the form and click 'Confirm' to send your withdrawal request.

Please note, withdrawal requests will be processed as BACs payments and therefore will take up to three days to clear from the date stipulated in your request. They will be returned to the UK bank account linked to your account, details of which can be found on your 'Account Overview' page.

Funds will be returned as per the terms of the CVA. A payment plan has been issued to each investor regarding their investments and payments are due to be paid in line with this.

Business accounts are treated exactly the same as sole and joint accounts throughout the process.

Wellesley processes withdrawal requests at approximately 3.30pm Monday to Friday. Withdrawals are processed by BACs; please allow four working days for funds to clear.

An ISA is a tax wrapper for your investment which means that you do not pay tax on the interest earned. It does not offer any additional protection or security on your investment.

Peer-to-Peer FAQs

Peer-to-Peer FAQs

Please click here and select 'Peer-to-peer investment' to see how your investment is impacted.

If you were a peer-to-peer customer, your suspended balance has been added back into your investment and is included within the figures displayed on the Wellesley Classic section of the site.; however, the suspended portion of your investment has a different estimated return versus live peer-to-peer investments. The estimated returns for Peer-to-Peer investments are £0.48 per £1 owed and £0.31 per £1 owed if you only have a suspended balance outstanding.

Wellesley Mini-Bond FAQs

Wellesley Mini-Bond FAQs

Please click here and select your Wellesley Mini-Bond's correct series to see how your investment is impacted.

No. As your investment is no longer live, you cannot give notice on it. Funds will be returned as detailed within your payment plan.

Wellesley Property Mini-Bond FAQs

Wellesley Property Mini-Bond FAQs

Please click here and select 'The Wellesley Property Mini-Bond' to see how your investment is impacted.

No. As your investment is no longer live, you cannot give notice on it. Funds will be returned as detailed within your payment plan.

When the loan book was sold, Wellesley Finance Limited successfully recovered a portion of the total value you invested. This is what is now known as the ‘secured portion’ of your investment. As part of the CVA, Wellesley intends on recovering further funds which is what is now called your ‘unsecured portion’ as it is no longer directly linked to the loan book.

When the loan book was sold, Wellesley Finance Limited successfully recovered a portion of the total value you invested. This is what is now known as the ‘secured portion’ of your investment. As part of the CVA, Wellesley intends on recovering further funds which is what is now called your ‘unsecured portion’ as it is no longer directly linked to the loan book.

The Wellesley Property Bond FAQs

The Wellesley Property Bond FAQs

Customers who held investments in The Wellesley Property Bond via Wellesley's platform (not The Share Centre) were sent an email on 16 November 2020 with information regarding their payment plan.

All information regarding your investment with The Share Centre is managed by The Share Centre (https://www.share.com/). As such, any questions or queries should be directed to them.

How Do I...?

How do I...?

Please complete the following steps below to withdraw funds from your Wellesley holding account:

- Login to your Wellesley account here.

- Click ‘Invest’ from the top bar menu.

- Click the ‘Withdraw Cash’ button on the account you wish to make a withdrawal from.

- Complete the ‘Cash Withdrawal Request’ form and click ‘confirm’. Please note that your account balance will only reflect your withdrawal request, after we have instructed it at approximately 3.30pm each working day.

Please note that funds will be returned to the bank account linked to your account. Details of which can be found on the Account Overview page on your account.

You can update these via your Wellesley account. Simply login to your account here, hover over the icon in the top right-hand corner and select the relevant option from the drop-down menu.

Your personal information can be found by clicking your name on the drop-down menu that can be found at the top right of your screen. Should any of this information need updating, please get in touch with our customer service team on [email protected]

Your bank account information can be found on the Account Overview page of your online account. Should you need to update your bank details, please get in touch with our customer service team on [email protected]

Please note we may require additional documentation to confirm the bank account details you provided are in your name and not a 3rd party.

Ensure you have available funds in your holding account.

- Log into your Wellesley account here.

- Click the red ‘Withdraw Cash’ button.

- Please complete the form and click ‘Confirm’ to send your withdrawal request.

Please note, withdrawal requests will be processed as BACs payments and therefore will take up to three days to clear from the date stipulated in your request. They will be returned to the UK bank account linked to your account, details of which can be found on your ‘Account Overview’ page.

- View an overview of total funds across your accounts.

- View the bank account details Wellesley has on file for you. This will be the bank account that any withdrawal requests will be paid into.

- View all account transactions. You can select the time-frame you'd like to look at via the calendar icon under the Recent Activity heading. This is where you can see all payments relating to your payment plans.

- Download a report of all activity

If you're a customer with a Wellesley Classic account, please note that this does not document historic transactions and will therefore only show transactions that have occurred on the new platform.

If you ever want to get back to the main Account Overview page of the dashboard, please click Clients from the top menu.

Your capital is at risk and interest payments are not guaranteed. Investment in any Wellesley products are not covered by the Financial Services Compensation Scheme (FSCS).

Wellesley is the singular name for the following collective of companies, Wellesley Group Limited (09811856), Wellesley & Co Limited (07981279) and Wellesley Finance Limited (08331511). Wellesley Secured Finance Plc was established as a special purpose vehicle for the sole purpose of issuing asset backed securities and is not part of Wellesley Group.

Resolution Compliance Limited (FRN 574048). and Wellesley & Co Limited (FRN 631197) are authorised and regulated by the Financial Conduct Authority (FCA). Wellesley Secured Finance Plc and Wellesley Finance Limited are not authorised or regulated by the FCA.

Wellesley & Co Limited and Wellesley Finance Limited are registered in England and Wales and their registered office and trading address is at St Albans House, 57/59 Haymarket, London SW1Y 4QX. The registered address for Wellesley Secured Finance Plc is at 1 Bartholomew Lane, London, EC2N 2AX.

Resolution Compliance Limited (No. 07895493) is a limited company registered in England & Wales with registered office at 2nd Floor, 4 St Paul’s Churchyard, London, EC4M 8AY, United Kingdom.

Require further information?

Please review our FAQs or contact the customer support service provided by Resolution Compliance Limited on [email protected]