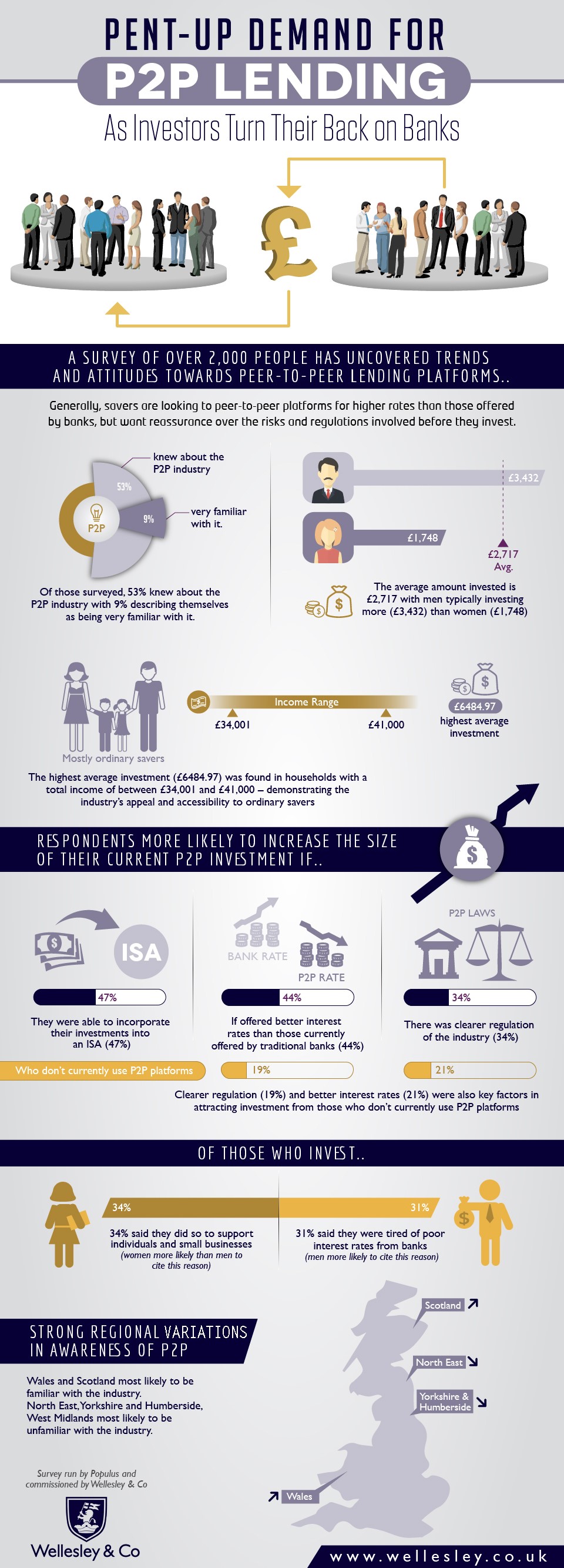

A national survey of 2000 people, conducted by Populus in May of this year, has uncovered various attitudes towards P2P lending and investment.

The demand for P2P is increasing, but some ordinary savers want more information and reassurance regarding the risks. The industry came under FCA regulation in April, and 19% of respondents said that this would encourage them to invest. 34% of those who are already familiar with the platform, say they would increase their investment if regulatory rules were clearer, but nearly half (47%) thought incorporating P2P into an ISA scheme would make them invest more.

Graham Wellesley, the Founder, Joint CEO and Chairman of Wellesley & Co has welcomed the fact that P2P is accessible to all, and this survey in particular “challenges the notion that P2P lending and investment is something that only the wealthy can afford to do.” In response to people’s concerns about potential risks and regulation, Wellesley reassured investors in lending platforms that “this is a regulated and increasingly transparent industry”, and is set to become “the natural mainstream investment choice for ordinary savers.”